Futures Market

Futures Contracts

There are Cereals (Corn, Barley, Wheat), Oilseeds (Rapeseeds, Soybeans), Soyoil and Soymeal Futures. Futures contracts are standardized except for the price, which is discovered via the supply (offers) and the demand (bids). We are have knowledge in fundamental and technical analyses of future commodities, forex markets. A futures contract is a commitment to make or take delivery of a specific quantity and quality of a given commodity at a specific delivery location and time in the future. This price discovery process occurs through an exchange’s electronic trading system or by open auction on the trading floor of a regulated commodity exchange.

- Details

- Parent Category: Contract Negotiation

- Category: Futures Contracts

- Hits: 12639

There are Cereals (Corn - CBOT, Chicago, USA ) Futures. We are have knowledge in fundamental and technical analyses of future commodities, forex markets. A futures contract is a commitment to make or take delivery of a specific quantity and quality of a given commodity at a specific delivery location and time in the future. FYI CBOT CORN, Matiff Paris Corn Futures. Corn - BMF, San Paulo, Brasilia. Future contract, Corn - Budapest

CBOT, Chicago, USA

Latest Previous

Previous

Corn - MATIFF, Paris, France

Please find below Corn - CBOT, Chicago, USA Contract Details, Trading Hours for the CBOT Corn Future.

Please find below Corn - CBOT, Chicago, USA Contract Details, Trading Hours for the CBOT Corn Future.

CONTRACT SIZE: 5000 bushels

- Details

- Parent Category: Contract Negotiation

- Category: Futures Contracts

- Hits: 13091

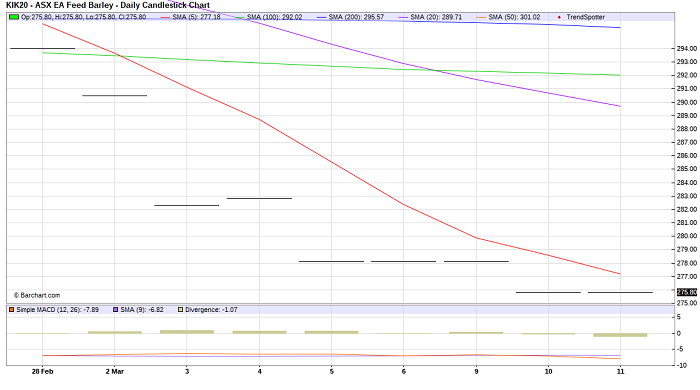

Feed Barley ASX Australia; Feed Barley Budapest, Hungary; ICE Canada Western Barley; Barley world wide (general info) are futures contracts for barley.

Feed Barley ASX Australia

Latest

Previous

Contract Unit: 20 Metric Tonnes

Quotation/Tick Size: Aud $0.10 Per Tonne, Tick Value $2.00 Per Contract

Contract Months: Jan, Mar, May, Jul, Sep, Nov.

Last Trading Day And The Third Thursday Of The Maturity Month,

Maturity Date: Provided This Is A Trading Day.

Trading Hours: 9.50am To 4.30pm (Sydney Time). Late Trading 4.30pm To 5.00pm. Trading Ceases At 12 Noon On Maturity Date.

Settlement Method: Physical Delivery

Settlement Day: The Business Day Following The Notice Day.

- Details

- Parent Category: Contract Negotiation

- Category: Futures Contracts

- Hits: 12120

Contract are standardized except for the price, which is discovered via the supply (offers) and the demand (bids). This price discovery process occurs through an exchange’s electronic trading system or by open auction on the trading floor of a regulated commodity exchange.

FYI Crude Oil WTI

Latest

Previous

Others Futures like CBOT Corn, Wheat, Soya, Soya Oil, Soya meal you can see in separate articles.

FOREX EUR-USD 19/02/2023

Index USD

latest

previous

All contracts are ultimately settled either through liquidation by an offsetting transaction (a purchase after an initial sale or a sale after an initial purchase) or by delivery of the actual physical commodity.

An offsetting transaction is the more frequently used method to settle a futures contract. Delivery usually occurs in less than 2 percent of all agricultural contracts traded.

- Details

- Parent Category: Contract Negotiation

- Category: Futures Contracts

- Hits: 13630

Futures contract Canola (Winnipeg, Canada) Latest, Previous

or Rapeseed (MATIFF, Paris) is a commitment to make or take delivery of a specific quantity and quality of a given commodity at a specific delivery location and time in the future. Please find below technical analises of Futures contract Rapeseed - MATIFF, Paris

Latest Previous

Previous

Conditions: FOB/mt; Unit of trading: Fifty tonnes; Origins tenderable: Any origin

Quality: Double zero variety, of sound, fair and merchantable quality of the following standards:

Oil content: basis 40% +/- 1.5% for each 1%

Moisture: max 9% +/- 1% for each 1%

Impurities: basis 2% max 3% +/- 1% for each 1%

Oleic acidity: max 2%

Erucic acid content: max 2%

Glucosinolates content: max 25 micromoles

- Details

- Parent Category: Contract Negotiation

- Category: Futures Contracts

- Hits: 11755

Soybean Futures - CBOT, Chicago, USA Contract Size 5,000 bushels (~136 metric tons) /2.7216=USD/Mt Deliverable Grade No 2 Yellow at contract price, No 1 Yellow at a 6 cent/bushel premium, No 3 Yellow at a 6 cent/bushel discount

Latest 15/03/2022

Pricing Unit Cents per bushel

Tick Size (minimum fluctuation) 1/4 of one cent per bushel ($12.50 per contract)

Contract Months/Symbols January (F), March (H), May (K), July (N), August (Q), September (U) & November (X)

Trading Hours CME Globex (Electronic Platform) 6:00 pm - 7:15 am and 9:30 am - 1:15 pm Central Time, Sunday - Friday

Open Outcry (Trading Floor) 9:30 am - 1:15 pm Central Time, Monday - Friday

- Details

- Parent Category: Contract Negotiation

- Category: Futures Contracts

- Hits: 11890

Terms and conditions for Futures Sugar No. 11; Sugar No 14; Sugar No. 16.

Detail for Sugar No. 16, FOB USD/mt, Unit of trading: Fifty tonnes

Quality: White beet, cane crystal sugar or refined sugar of the crop current at the time of delivery, free running of regular grain size and fair average of the quality of deliveries made from the declared origin from such crop, with:

- polarisation minimum 99.8 degrees,

- moisture maximum 0.06% and

- colour of a maximum 45 units ICUMSA attenuation index,

all at time of delivery to vessel at the port.

Latest

Delivery months: March, May, August, October, December, such that eight delivery months are available for trading.

- Details

- Parent Category: Contract Negotiation

- Category: Futures Contracts

- Hits: 16023

CBOT Chicago Wheat, Black Sea Wheat Futures; Milling Wheat - Asx, Australia; Euro Wheat - Budapest, Hungary; and etc.,

Futures MATIFF, Paris, France - milling wheat;

---

CBOT Chicago Wheat Futures

Latest

Before

Size: 5,000 bushels (~ 136 Metric Tons) xx/2.7216=usd/mt